Introduction

In this article we will explain how prices and returns of ASICs vary during the Bitcoin cycle. Considering the price of electricity as fixed, competitive and non-variable, the factors we will have to take into consideration are:

Bitcoin

Competitors

Efficiency

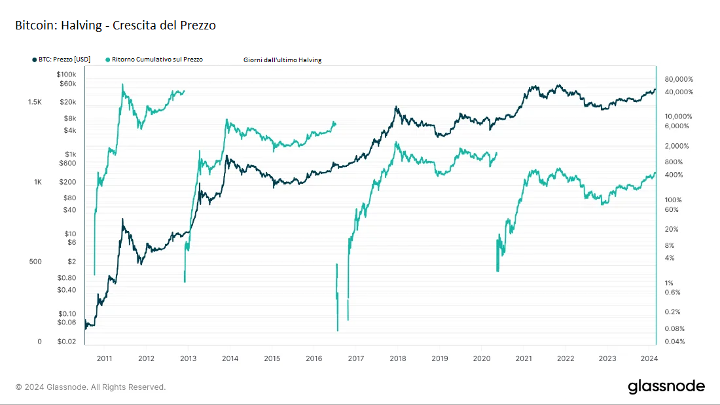

Bitcoin Price

Bitcoin has a cyclical trend marked by halving, this occurs approximately every four years. The halving consists in halving the new units issued at each block, thus reducing the increase in supply and stimulating a growth in price as well as value.

The price is also influenced by the strong selling pressure from mining companies who, in view of the imminent halving, are selling their bitcoins to buy new machines and prepare to face the new cycle to the best of their ability.

Profittabilità del Mining

The growth in the price of bitcoin makes mining more profitable which, while maintaining the same energy cost, generates bitcoins for a much greater value.

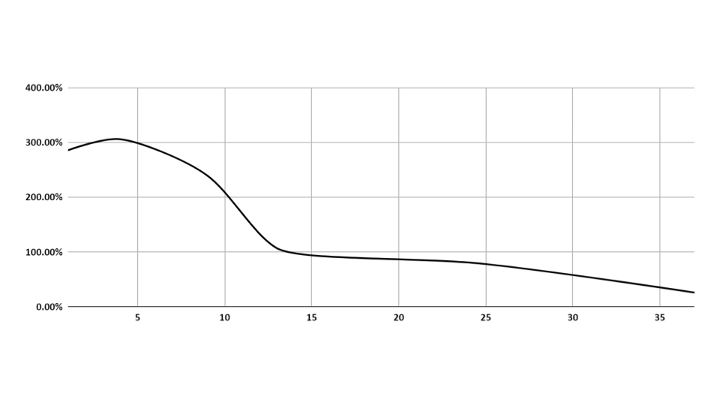

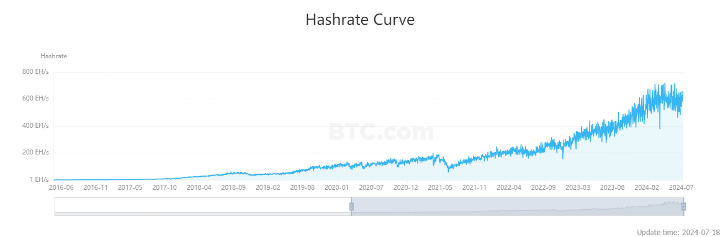

Here is a chart that shows how the average monthly profitability in the various phases of the cycle:

Competitors

As the block reward decreases, miners must ensure their operations remain profitable by optimizing efficiency.

In fact, in the first months following the halving there will be a change in the figures in the sector, miners with inefficient ASIC or obsolete ones will gradually exclude themselves from the business, leaving space and rewards to those who invest in more modern and efficient equipment destined to live the whole new cycle.

As the cycles continue, the entry barrier becomes increasingly greater and limiting for those who were left out of the business in the previous cycle and more profitable for those who, understanding the phases, ride the new one right from the start.

ASICs Efficiency

Next-generation ASICs offer higher hash rates and power efficiency than previous models, making them more attractive to miners looking to maintain or improve their competitive advantage.

This surge in demand leads to an increase in prices for the most cutting-edge machines. As a result, the period before and after the halving often sees a spike in sales and a corresponding increase in ASIC hardware prices.

With the advent of next-generation ASIC miners, older-generation hardware is facing a harsh reality. The efficiency gap causes older models to become less profitable, especially in the wake of a halving that dramatically reduces block rewards leading most miners to phase out their aging equipment.

For the market, this means an increase in the supply of used ASICs, which could further drive down prices for these older models making it mandatory for miners to consider the lifespan of their hardware and potential depreciation when calculating the return on investment for any ASIC drives, especially as halving approaches.

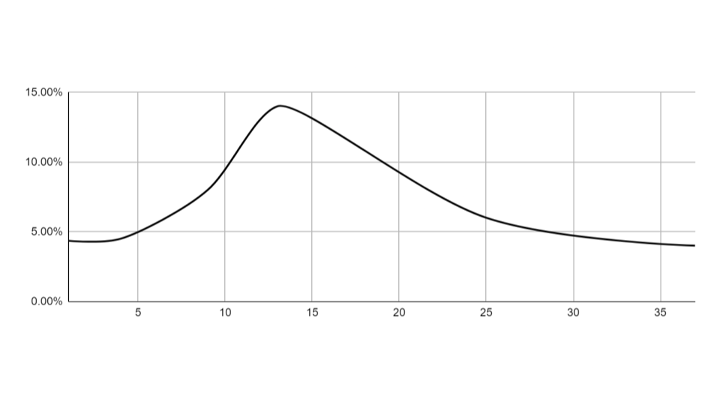

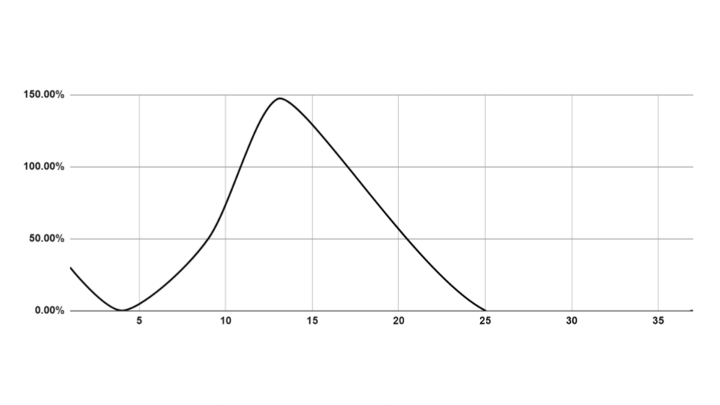

Chart that shows how the price of ASICs varies based on the time of purchase:

Conclusion

In light of these considerations, the purchase of the latest generation ASICs a few months after the halving will allow you to pay for the machine without surcharges and to mine at the moment of greatest profitability. The machine will thus be usable for its entire life cycle and with a more than optimal return on investment.

Here is a chart showing how total return varies based on the time of purchase: